Bitcoin Holding Support Ahead of US Inflation

BTC Holding Support

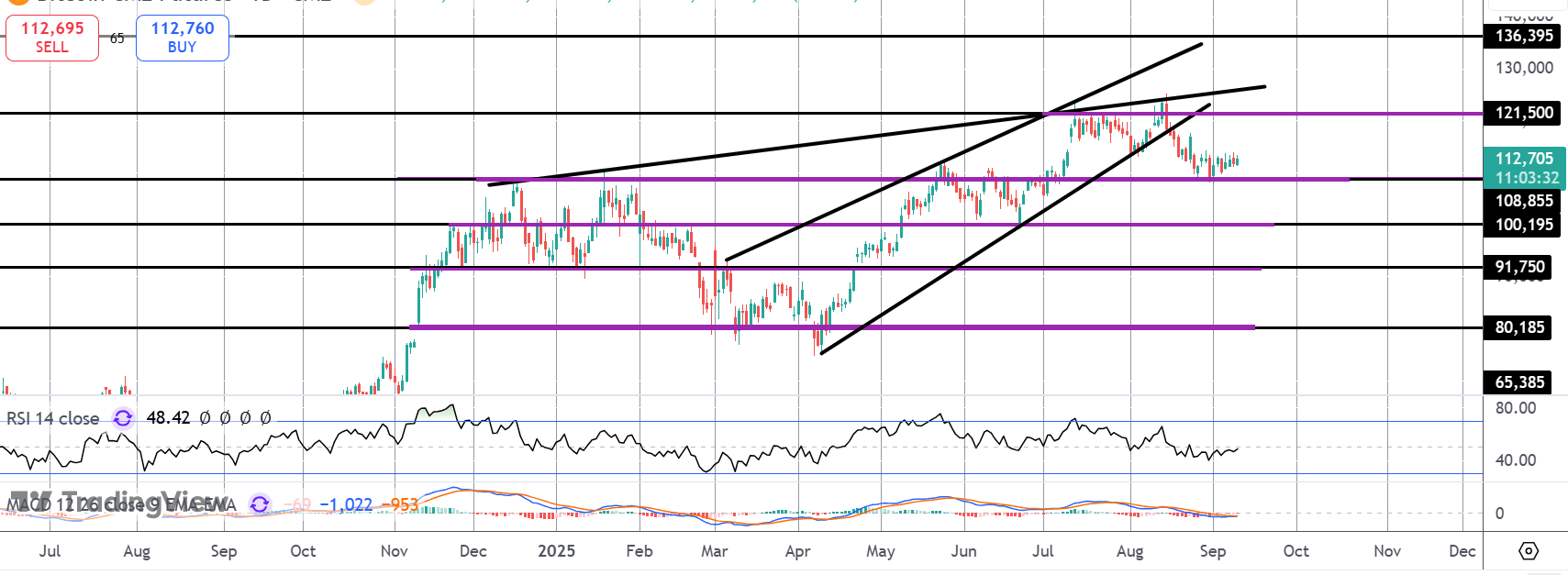

Bitcoin prices continue to tread water midweek with the futures market remaining inside Friday’s range for now. Following the correction lower from August highs, BTC has been underpinned by support at the $108,855 level and while this area holds, focus is on a resumption of the bull trend and an eventual break higher. For now, the macro backdrop remains supportive for BTC. Better regulatory support increased mainstream uptake and a dovish shift in Fed expectations should keep BTC supported near-term.

Inflation On Watch

Given that BTC tends to trade in line with general risk appetite and the broader risk complex, the Fed and US rate expectations are a key element to monitor. Looking ahead this week, traders will be watching incoming US inflation data with PPI due later today and the headline CPI report due tomorrow. If a further rise in inflation is confirmed, this could cause some temporary cooling of risk assets, leading BTC lower near-term. However, if we see any downside surprise in the data, this will be firmly bullish for BTC as risk assets advance into the September FOMC meeting next week.

ETF Inflows

ETF flows remain a key driver and signpost for BTC price action following the SEC approval of BTC ETFs earlier this year. Despite the correction lower, ETF inflows have been rising recently at the same time as retail traders exiting the market. This particular dynamic has previously led to fresh breakout rallies in BTC meaning that while ETF inflows continue to grow BTC looks poised for a breakout near-term.

Technical Views

BTC

The correction lower in BTC has stalled for now into the $108,855 level. While this level holds, the focus is on a resumption of the bull trend and a fresh rally with $121,500 the local resistance to note and $136,395 the next target for bulls. To the downside, if $108,855 breaks the $100k level will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.