BTC Bouncing Back

Bitcoin prices are seeing strong demand through early European trading on Monday. Following heavy selling last week which saw the futures market plunging around 10% on the week, BTC is bounding back today and as broken back above the $108,855 level. This is an important development suggesting the potential for a resumption of the bull trend if price can hold above that support.

Institutional Flows

The velocity of the move today suggests the return of institutional demand which has been a key driver behind any bull phases in BTC this year. Record outflows over the last fortnight were seen amplifying the decline in BTC. However, with price now bouncing sharply the next ETF update we see will likely reflect fresh buying from mainstream investors. Notably, we heard from Michael Saylor last week that his Strategy fund had bought heavily into the dip and this week headlines show that veteran trader Peter Brandt who had once been a heavy Bitcoin bear has now turn bullish on the coin, calling for a move to fresh highs this year.

BlackRock Launch UK Crypto Offering

On the subject of ETFs, investment giant BlackRock, whose US BTC ETF has been the biggest draw for investors, this week announced a UK offering. With the UK crypto market growing at a rate of around 12% a year, the BlackRock iShares Bitcoin ETP opens the BTC market up to a new pool of demand which should feed into higher prices near-term if uptake is as strong as it was when launched in the US earlier this year.

Technical Views

BTC

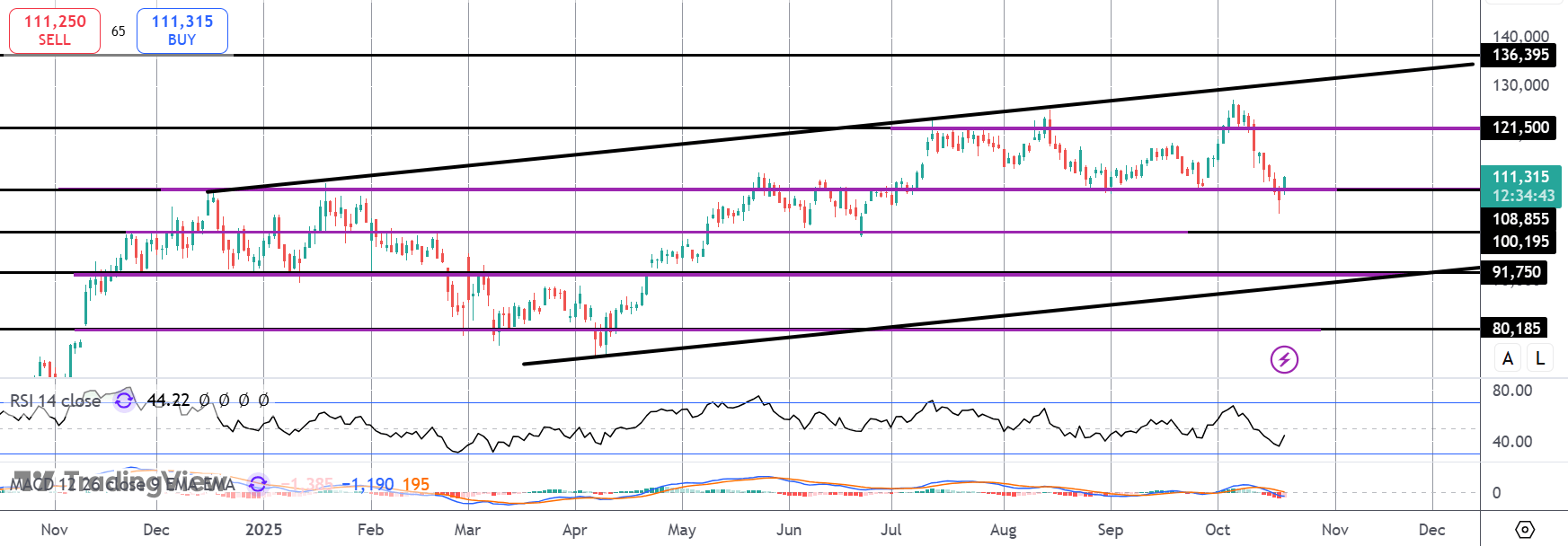

The sell off in BTC has found strong demand today with price now bouncing back above the $108,855 level. While above here focus is on a resumption of the bull trend and a fresh rotation back up towards $121,500 initially and the YTD highs above. If we break back below this level, however, focus turns to $100k next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.